The Darvas Box indicator is suitable for both long-term traders and short-term traders. You can also choose between simple moving average or exponential moving average. The boxes are formed according to the MA length. This is a great tool that is set according to your personal trading style. When the price action is above the MA, only long boxes will be plotted when the price action is below the MA, only short boxes will be plotted.

DARVAS BOX CODE

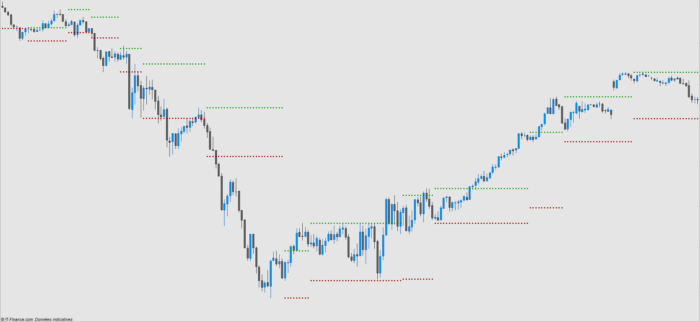

If you choose to see both, the code automatically uses a moving average (you can choose to use a simple or an exponential moving average) to choose between long or short boxes. You can control what boxes you want to see, only long or only short boxes, or you can choose to have both. You can now receive both bearish and bullish boxes on your chart. We have taken our Darvas Box a few steps forward. The original Darvas Box technique only works in bullish markets. You can see that almost immediately after it is formed its lower line is tested and it serves as a great support level from there, the price rises up and bounces off the top of the box. GBPUSD Forex 15 Min Chart: Let’s start with the box on the left. The Daravs Box should be put on high time frames such as weeks or days and the box values should be used as strong support and resistance lines on lower time frames. Once the box is formed, its top and bottom often serve as strong support and resistance areas. The Darvas Box as Support and ResistanceĪnother way to use the Darvas Box is in support and resistance areas. In the right side of the box, you can see that a potential buy signal is created when the price breaks through the top of the box. Note that about 5 bars before the real break a false breakout takes place but is dismissed by the indicator (the indicator filters false breakouts using minimum breakout size inputs). S&P 500 Daily Chart: On the left you can see that a potential sell signal is created when the price falls below the bottom of the box.

It identifies consolidation and gives you a visual marking on the chart, making it easy to see a breakout in either direction. It has great control over its sensitivity and how many or few boxes you see – based on volatility. The Darvas Box indicator works well as a breakout indicator – in either direction – long or short. On the left you can see that a short (bearish) box is formed when the price pulls up and then straight down the lines are extended until one of them is broken (in our case, the top line is broken). GOOG Daily Chart: On the left you can see that a long (bullish) box is formed when the price pulls down and then straight up the lines are extended until one of them is broken (in our case, the bottom line is broken).

The Darvas Box lines are extended until a potential buy signal is created when the price breaks through the top of the box or a potential sell signal is created when the price falls below the bottom of the box.Ī short Darvas Box is created when the price pulls up and then straight down and the price range consolidates into a form of box. Our enhanced version provides a new functionality that allows the indicator to work in both bullish and bearish markets and to provide signals on both high and low time frames, such as hours and minutes.Ī long Darvas Box is created when the price pulls down and then straight up and the entire price range consolidates into a form of box. The system was intended for use only in bullish markets and for weekly and daily charts. The Darvas Box trading system was developed in 1956 by Nicolas Darvas it was originally designed to identify key breakouts that usually lead to strong trends.

0 kommentar(er)

0 kommentar(er)